Coinbase Exchange Faq

A detailed comparison between Binance and Coinbase exchange.

Buying and selling crypto is taxable because the IRS identifies crypto as property, not currency. As a result, tax rules that apply to property (but not real estate tax rules) transactions, like selling collectible coins or vintage cars that can appreciate in value, also apply to bitcoin, ethereum, and other cryptocurrencies. Uniswap — Which Exchange Is Better? The debate about whether decentralized exchanges are better than centralized exchanges has been raging in the crypto world for years now. In theory and in spirit, most cryptocurrency users probably side with decentralized exchanges considering that cryptocurrency is, well, decentralized.

For anyone new to the world of cryptocurrencies, getting to grips with the variety of coins on offer can be intimidating. The same can be said for the wide range of cryptocurrency exchanges that service the sector, and chances are that even if you are still new to the scene, you’ve heard of Coinbase and/or Binance.

The two are arguably the leading exchanges at the moment, and provide services that suit beginner traders and investors while also catering to more advanced operators. As a result, we take a look at the two cryptocurrency exchanges and compare them to see how they match up, and who might benefit from using them.

Overview

Binance

Binance is a relatively young upstart by comparison, and launched in 2017. The exchange was founded by the ex CTO of OKCoin, Changpeng Zhao who raised $15 million in funding via an ICO (Initial Coin Offering).

Despite its relative youth, the exchange has become extremely popular, and is the go to option for a large percentage of the crypto trading community. The exchange has mostly operated as a crypto to crypto platform, and provides access to over 500 different cryptocurrencies. However, earlier this year, the exchange partnered with Simplex to enable crypto purchases via credit and debit card. Binance has also moved the location of its headquarters numerous times and after operating out of China, and Japan, is currently based in Malta. The exchange also allows its users to trade without having to undergo extensive KYC identity checks.

Coinbase

Coinbase is one of the most established cryptocurrency trading platforms in operation and dates back to 2012. It was launched by Brian Armstrong and Fred Ehrsam, and is based in San Francisco, USA. The exchange enjoys a good reputation and has been backed by venture capital and investment firms such as Union Square Ventures, Digital Currency Group and Andreessen Horowitz. Coinbase is transparent in nature and operates in line with regulations and applies strict KYC/AML policies. The exchange can be accessed from more than 100 countries and while it offers a rather limited selection of digital assets, it also allows its users to make fiat to crypto transfers and vice versa.

Supported Currencies

Coinbase Cryptocurrencies

Up until recently Coinbase only provided access to Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. However, over the past year or so the exchange has begun to list more coins and now provides universal access to around 17 digital assets. These new additions are mostly ERC-20 tokens and include LINK, BAT, ZRX, and REP, alongside stable coins like DAI and USDC. High cap cryptos like XRP, EOS, and XLM are also supported.

Most importantly, Coinbase allows itsusers to use fiat currencies as a payment method, and supports ACH (US), SEPA(Euro), and Faster Payments (UK) bank transfers. Anyone outside of theseregions can make deposits and withdrawals via credit and debit cards which isstill quite a unique feature for a cryptocurrency exchange.

Binance Cryptocurrencies

Binance is something of a market leader in this area, and made its name as a crypto to crypto exchange. The platform currently supports over 500 digital currencies and suits anyone looking for a greater range of tokens to trade. Binance provides trading pairs based on digital assets including Bitcoin, Ethereum, Binance Coin (BNB), and stablecoins such as Tether. Using BNB can help to lower your trading fees on platform, and after being known for listing ICO tokens, Binance also uses its Launchpad to promote and list new projects.

As a result, Binance is home to largecap, medium cap, and small cap projects, as well as ERC-20 (Ethereum network), NEP-5(Neo network), and BEP-2 (Binance chain) tokens. While the exchange does notallow bank transfers, a recent link up with Simplex allows its users to makepurchases of selected coins via credit/debit cards.

Fees

Binance Fees

This is another area in which Binance holds a significant advantage. The platform features low fees in comparison to other exchanges, and adds a fee of 0.1% per trade for anyone conducting less than 50 BTC/BNB worth of trades within a 30 day period. This fee becomes reduced once these limits are passed, and also if you pay for transactions using BNB tokens. Withdrawal fees depend on the digital assets being transferred and also change over time and Bitcoin currently accrues a withdrawal fee of 0.0005 BTC.

Coinbase Fees

Coinbase is known for having highfees and they vary depending on the trade amount, jurisdiction, and the paymentmethod used. Here “variable” standard buy/sell rates range from 1.49% to 4%.However, Coinbase sets it fee charge to be the greater of (a) a flat fee or (b)the previously mentioned variable fee determined by region, product feature andpayment type.

The flat fee rates are as follows:

- For a transaction amount of up to $10, the fee is $0.99.

- For a transaction amount between $10 and $25, the fee is $1.49.

- For a transaction amount between $25 and $50, the fee is $1.99.

- Foe a transaction amount between $50 and $200, the fee is $2.99.

For transactions than $200, Coinbase adds a variable fee of 1.49% to your total, and credit or debit card purchases accrue an additional 3.99% fee. Furthermore, the base rate for all Purchase and Sale transactions in the U.S. is 4%; however, Coinbase waives a portion of the transaction Fee depending on the payment method used. The fees can start to add up, and it’s a good idea to have a look at the official fee structure to keep on top of things.

Ease of Use

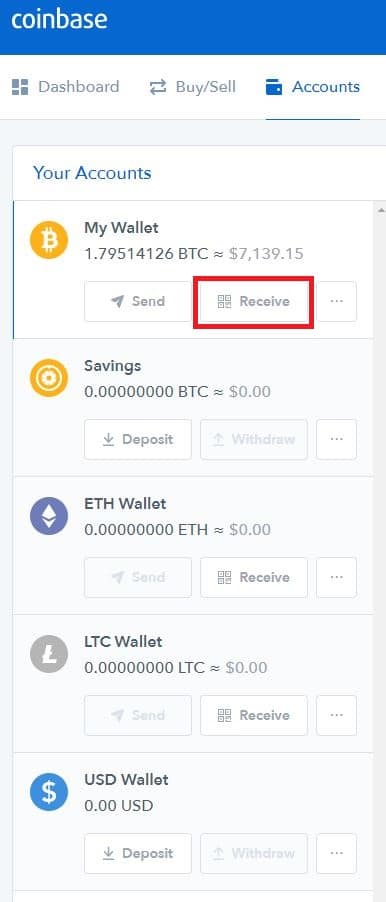

When comparing the two platforms,it’s safe to say that most people will find Coinbase easier to use when theyfirst get started. The interface is well designed, and everything is keptsimplistic which makes it easier for newbies to stay on top of what they aredoing. The layout keeps things simple, and the dashboard contains an overviewof your portfolio, coin prices, and provides you with your recent activity/transactionhistory. The other tabs are also easy to spot and the limited amount on coinson the platform also helps to keep things relatively simple. All in all,Coinbase is one of the easiest platforms to use for anyone new to buying andselling cryptocurrencies.

Binance comes with a slightly sharperlearning curve, and people usually move onto Binance after gaining someexperience dealing with other exchanges. Most importantly, the platform allows you to choose between two differentinterfaces, namely Basic and Advanced.

The basic version is aimed at beginners,and contains all of the most important features on the main page. The chartsand order box take centre place, while the right hand side contains the listsof BNB, BTC, Altcoin, and Stablecoin markets that users can trade in. Pricelists that are updated in real time are displayed on the left side of the page.While more difficult to use than Coinbase, Binance’s Basic mode is still one ofthe more easy to use interfaces for crypto exchanges that deal with a range ofaltcoins.

The Dashboard is also more difficultto navigate and contains more tabs and features than those offered by Coinbase.Again, it’s usually not the first destination for new traders but the exchangeprovides a number of guides to help you to get to grips with it, and things aregenerally well laid out.

Security Measures

Coinbase Security

Coinbase makes use of industry standard security protocols such as passwords and two factor authentication (2FA). Here, 2FA can be used by phone, or apps such as Authy or Google Authenticator. Coinbase also notifies users when a new IP address or device tries to gain access to their account.

The exchange is also transparentabout its storage methods, and 98% of customers’ crypto assets are storedoffline via both hardware and paper wallets that are also stored in secure vaultsand safety deposit boxes across a number of global locations. Coinbase alsouses fund segregation to keep customer funds separated from company operationalfunds. Customer funds are stored in custodial bank accounts and, only Coinbasecustomers have any legal rights to the funds.

Any funds stored online are fullyinsured by a syndicate of Lloyd’s of London, and United States residents usingthe USD wallet are covered for any amount up to $250,000 as a result of FDICinsurance. However, despite this, it’s important to remember that customers arestill liable for their losses if their personal accounts get compromised.

Binance Security

Binance while well respected is less transparent about its security protocols. However, personal account security is top notch with 2FA and email verifications operating as standard. Users can also choose to adopt further security methods such as using an external device like a Yubikey for verification. Most importantly, the exchange suffered a hacking attempt in March 2018 which was picked up by internal security systems and thwarted as a result.

Furthermore, Binance was eventually breached in May 2019, when a hacker gained access to user information such as API keys and withdrew over $40million worth of crypto assets. However, Binance covered these loses in full using their Secure Asset Fund for Users (SAFU) security fund, and reimbursed all users who suffered losses.

Regulatory Compliance

Coinbase is based in the USA, andcomplies with U.S. laws and regulations at all levels. The exchange complieswith the Bank Secrecy Act, the USA Patriot Act, state money transmission lawsand regulations, and is registered as a Money Services Business with FinCEN. Asa result Coinbase is fully accountable and transparent in its operations, andis one of the industry leaders in this regard.

Interestingly, when the USInternational Revenue Service (IRS) made a request for the records of all UScitizens purchasing BTC between 2013 and 2015, Coinbase managed to protect itscustomers by narrowing the scope of the investigation, and Coinbase was finallyruled to provide the personalinformation of US customers who made transactions greater than $20,000 in asingle year between 2013 and 2015.

While remaining professional in itsoperations, Binance is known to be less friendly with the authorities, and theexchange has moved its head office from Shanghai, China to Japan, andthen onto Malta in an effort to stay ahead of strictregulators. Despite this, the exchange moved to restrict UScustomers in August 2019, and announced that they would eventually block US residentsfrom making trades and deposits on the platform.

Customer Support & Additional Resources

Coinbase offers customer supportthrough email, and responses typically take around 24 to 72 hours. The exchangealso provides an extensive Knowledge Base and FAQ section on their site whichis helpful for new traders. Coinbase Earn is a learning portal that allows verifiedmembers to learn about selected coins and receive payouts in the coin aftercompleting a course.

Educational tasks include watchingvideos, and filling out quizzes, and cover coins such as Stellar Lumens (XLM), Tezos(XTZ), Basic Attention Token (BAT), and Maker Dai (DAI). Coins received aftercourse completion are stored in your Coinbase wallet, and can be traded afterbeing received.

Binance operates a similar emailsupport system and customers can also contact the team by submitting supporttickets via an online form on the website, and responses are made via email. However,responses are known to take a while, and there is no current live chat support feature.Binance outdoes most other exchanges with regards to its learning resources andon top of its FAQ and Support Center section it also provides learningresources via its Binance Academy, Binance Info, and Binance Researchoffshoots.

Sister Platforms

Coinbase Exchange Faq Free

Coinbase Pro

A more advanced alternative to Coinbase called Coinbase Pro is tailored to more experienced traders and contains a wider range of features. These include more extensive charts with a full range of technical indicators, more complex order types, and margin trading. Coinbase Pro also enjoys lower fees and suits Coinbase users looking for additional features or who are ready to upgrade their trading experience.

Binance Regional & Binance DEX

Despite its relative youth, Binance continues to expand at a rapid rate and has launched fiat to crypto exchanges including Binance Jersey for European customers, and Binance Lite Australia for its Australian client base. The exchange has also launched Binance Uganda to serve the African market and most importantly has also launched Binance US which serves the US market and requires full KYC identity verification. Binance also launched a DEX (Decentralized Exchange) platform in April of 2019.

Coinbase Exchange Platform

Binance vs Coinbase: Comparison Table

Conclusion

Both Coinbase and Binance are solid choices for anyone interested in trading cryptocurrencies and the two exchanges generally serve two different market sectors. Coinbase is a great choice for a beginner who wants to gain quick access to a few leading cryptocurrencies such as Bitcoin and Ethereum. It also suits anyone looking to purchase coins via traditional financial methods such as bank transfers and debit/credit cards. The overall ease of use and commitment to remaining regulatory compliant makes Coinbase an overall safe choice for traders of all levels. If you’re interested in learning more about other exchanges, checkout our post titled Top 7 Coinbase Alternatives.

Binance benefits from providing access to a wide range of coins and facilitating low fee trading. While more difficult to use, it provides a top notch service and caters to anyone with a more intermediate understanding of dealing with cryptos. Its more advanced interface allows for swing trading and the relaxed verification requirements suit anyone reluctant to provide their personal information. All in all, both exchanges suit different requirements, and can be seen as complementary service providers for the crypto trading community.

How does Converting Cryptocurrency work?

Users can trade between two currencies directly. For example: exchanging Ethereum (ETH) with Bitcoin (BTC), or vice versa.

- All trades are executed immediately and therefore cannot be canceled

- Fiat currency (ex: USD) is not needed to trade

How do I convert cryptocurrency?

Coinbase Exchange Faqs

- Sign in to your Coinbase account or into the Coinbase mobile app

- Find the asset page for the cryptocurrency you would like to convert from. For example, https://www.coinbase.com/price/bitcoin

- There will be a panel with the option to convert one cryptocurrency to another

- Enter the fiat amount of cryptocurrency you would like to convert from in terms of your native fiat currency. For example, $10 worth of BTC to convert into XRP

- Select Preview Conversion to see the amount of XRP you would convert from BTC

- If you do not have enough crypto to complete the transaction, you will be prompted to buy some

- Confirm the conversion transaction

Please see the Locations and trading pairs help article for all crypto-to-crypto trading pairs.

Please note, Coinbase charges a spread margin of up to two percent (2.00%) for Digital Currency Conversions. The actual spread margin charged varies due to market fluctuations in the price of Digital Currencies on Coinbase Pro between the time we quote a price and the time when the order executes. We do not charge a separate Coinbase Fee for Digital Currency Conversions.

To see availability depending on country and cryptocurrency type, please see Supported cryptocurrencies.